30000+

LOAN APPLICATION PROCESSED

100+

FINANCIAL ADVISORS

20000+

SATISFIED CLIENTS

50000+

EXPERT MAN-HOURS EXPERIENCE

Trusted & Reliable: We are your gateway to a stress-free loan experience. Our team of experienced professionals ensures a smooth and transparent process. On-Ground Support, Nationwide Reach: We have a network of experts across India, assisting you with any type of loan or working capital need.

Unmatched Loan Options: From personal loans and home loans to business loans and machinery loans, we cover it all. We also offer OD/CC, LC/BG, and more.

Your Advantage is Our Priority:

Lowest Interest Rates: We negotiate the best possible rates on your behalf.

Minimal Documentation: We streamline the process to save you time and hassle.

Fast Processing: Get the funds you need quickly and efficiently.

Investment Expertise (No Commission Charge): We offer unbiased investment advice in property, helping you grow your wealth.

Competitive Rates:

Personal Loan: Starting ROI 9.99%

Business Loans: Starting ROI at 13.75%

Let LoanGuruIndia be your trusted financial partner. Contact us today for a brighter financial future!

LOAN APPLICATION PROCESSED

FINANCIAL ADVISORS

SATISFIED CLIENTS

EXPERT MAN-HOURS EXPERIENCE

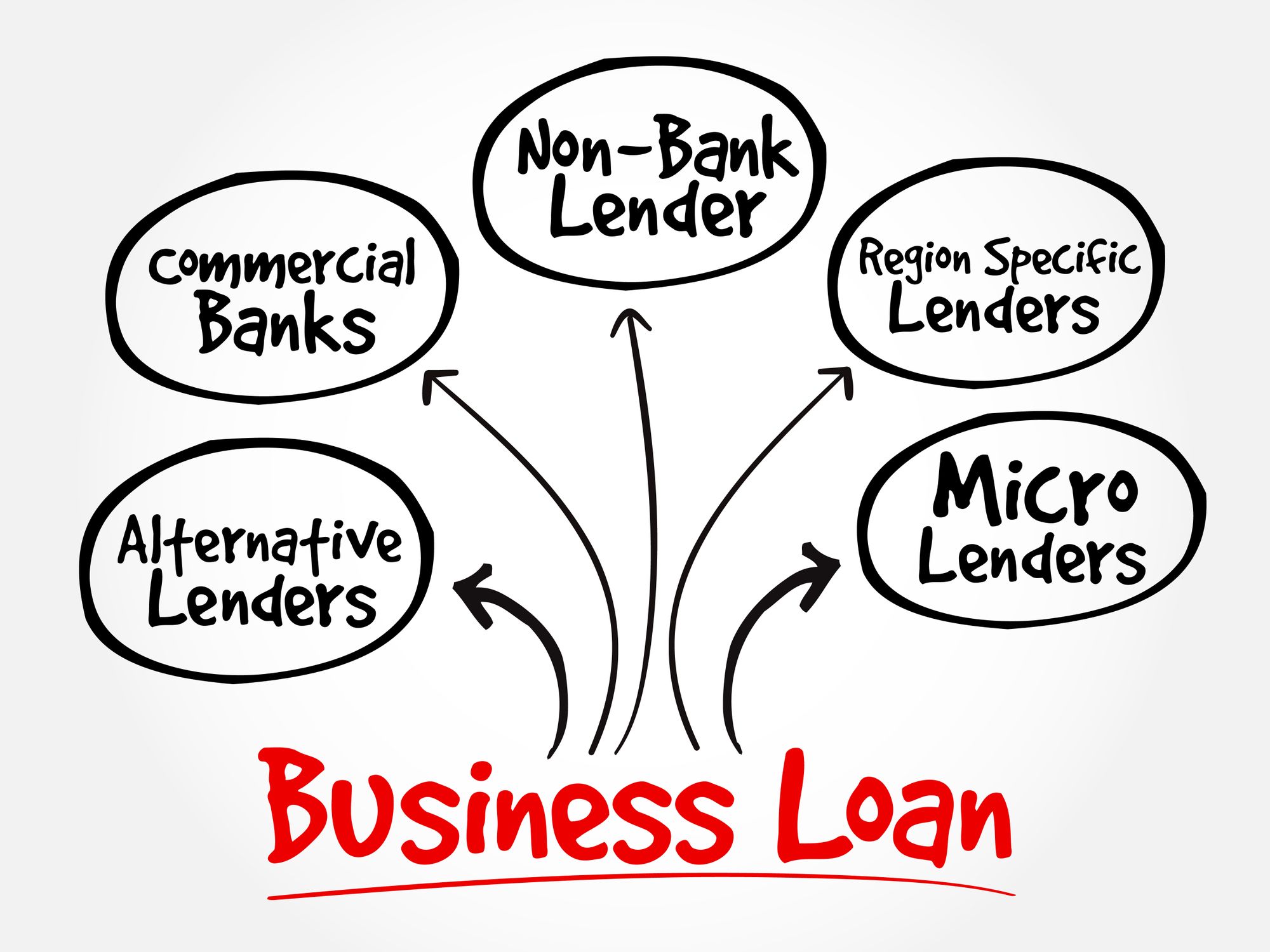

Business loans provide a strategic source of capital to meet your company's objectives. Whether you're launching a venture, expanding operations, or managing cash flow fluctuations, these loans offer flexibility to achieve your financial goals.

A Loan Against Property (LAP) is a secured loan you get by using your property as collateral. Think of it like a secured credit card, but for a much larger amount of money. Since the lender has your property as a guarantee, they are more likely to give you a loan and may offer a lower interest rate than an unsecured loan. LAPs are a good option for people who need a large sum of money for things like home renovations, business ventures, or debt consolidation.

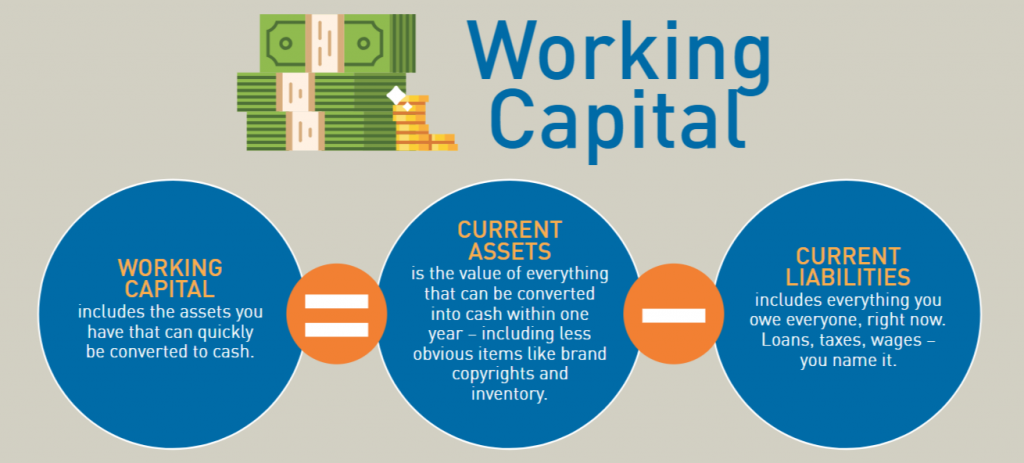

Working capital is basically a measure of a company's short-term financial health. It tells you if they have enough cash on hand to cover their upcoming bills. Imagine it like this: working capital is the money left over after you subtract what you owe (current liabilities) from what you have (current assets) like cash, inventory, and money owed to you by customers. A positive working capital is ideal, because it means the company can cover its short-term obligations and keep running smoothly.

Not just a set of tools, the package includes ready-to-deploy conceptual application.